Subject removal is an important and exciting stage when buying a home. No matter if you’re a first time home buyer or you’ve done multiple deals, the subject removal process is important to understand.

By the end of this guide, you’ll have a complete understanding of how the subject removal process works, typical subjects included in a residential real estate deal, what happens after and more!

Let’s dive in!

Table of Contents

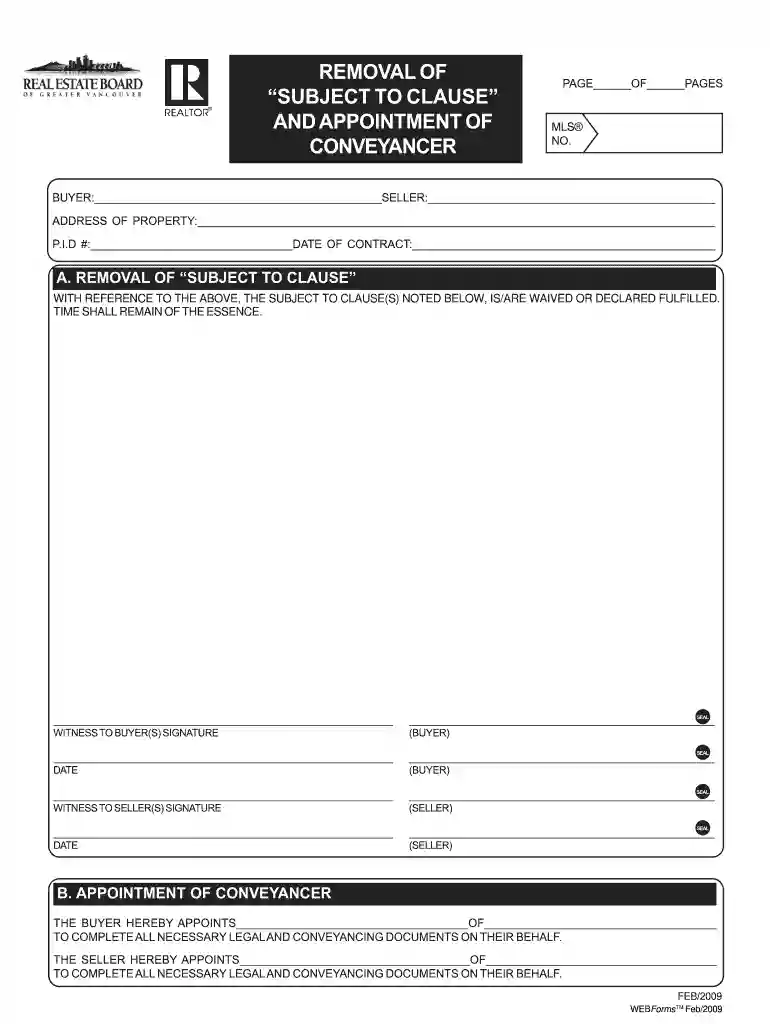

Sample Subject Removal Form

Here you can check out a sample Subject Removal form for BC.

Overview of the Subject Removal Process

It’s important to know the steps, considerations, and time needed to go through the process of removing subjects on a property you’re making an offer on or selling. Although you’ll typically have a trusted Vancouver Realtor working with you to drive this process, it’s always good information to understand.

The typical subject removal process takes about 5 to 10 business days, let’s dive into what happens during this time…

1. Accepted Offer, Timelines, and Inclusion of Subjects

Step 1 Timeline: 1 Day – Typically 24 to 48 hours from when the offer is made.

When a buyer makes an offer on a property, they often include conditions called “subjects” that must be met before the deal can move forward. This is included in the Contract of Purchase and Sale.

These subjects act as protections for both the buyer or the seller, depending on what the clause is. Ultimately to ensure that each party can address important aspects of the property, financing, timelines, etc. before committing.

The timeline for subject removal is typically negotiated during the offer process. Standard timeframes range from 5 to 10 business days but can vary depending on market conditions and the specifics of the transaction.

Shorter timelines are common in competitive markets, like a sellers market, while longer periods may be agreed upon for more complex properties.

Recommended Reading: What is The Cooling-Off Period in BC?

2. Conducting Due Diligence

Step 2 Timeline: 3 to 8 Days

Once the offer is accepted with the relevant subjects included by both the buyer and seller, it’s time for the respective parties to get to work in conducting their due diligence.

For a Home Buyer, this typically looks like:

Financing

Having a Subject to Financing clause is typical unless you’re buying the property with a 100% cash deal. As a buyer, you will ideally already have been dealing with a mortgage broker or lender to get mortgage approval. That way, the final step of confirming financing, getting a property appraisal and finalizing your mortgage is quick and easy. Financing can also be dependent on things like securing home insurance for the property. This confirmation from your lender or mortgage broker can take anywhere from 24 hours to 5 business days.

Home Inspection

A professional home inspection is typically done to identify any potential issues such as visual structural problems, plumbing problems, or electrical faults. Your Realtor will have recommendations for who to consider, and they usually can do the home inspection quickly, within 1-3 days.

Strata Document Review

For condos or strata properties in BC, it’s important to thoroughly review strata documents like meeting minutes, financial statements, and bylaws to understand the building’s health and any upcoming assessments. This process can take anywhere from an hour to several hours.

Pro Tip: Review Your Strata Documents with your Realtor in advance, so you can put forward an offer with less conditions. This can help in getting an accepted offer.

Title Search

The purpose of the Title Search is to make sure there are no liens, disputes, or legal issues tied to the title of the property. The title needs to be free and clear of any issues so it won’t affect your ownership.

A title search will help uncover these areas.

For the Home Seller, while it is rare for sellers to add Subjects, it does happen, such as:

Seller’s Purchase of Another Property (“Subject to Seller Finding Suitable Accommodation”)

In a scenario where someone is downsizing or even upsizing, the sellers may add a subject that allows them to exit the deal if the purchase of another property falls through. This can help protect a seller so they don’t end up without a home to move into.

Subject to Discharge of Financial Encumbrances

If there are financial obstructions like a lien or court order on the property, a seller may add a clause that the sale is conditional upon discharge of those obligations by a certain date.

While it’s not typical of a seller to add subjects to an offer, it’s important to understand that this does happen from time to time, and depending on the complexity of the deal.

3. Consulting with Professionals

Step 3 Timeline: 1 Day

No matter the amount or complexity of the subjects in the Contract of Purchase or Sale, it’s important to consult with and deal with your Realtor during this process.

They are experienced in going through the subject removal process, can help guide you on making important decisions about subject removals, and should offer sound advice if something unexpected happens.

Similarly, your chosen mortgage broker will also be able to help you if anything related to your financing comes up unexpectedly.

It’s time to lean on these professionals for any questions you may have, concerns, or areas you need to understand further. They are there to help.

Recommended Reading: How Buyers Agents / Realtors Help You

5. Decision to Remove Subjects or Withdraw from the Deal

Step 4 Timeline: 1-2 Hours

Once you’ve satisfied all conditions on the Contract of Purchase and Sale, it’s time to officially remove the Subject Clauses, OR, walk away from the deal if you’re unsatisfied with the results.

However, it’s important to keep in mind that a buyer cannot decline to remove Subjects because they’ve found a more suitable property.

Seller’s Role During Subject Removal

While typically the Subject Clauses are added by the buyer during the Offer and work is done on their end to fulfill those, the sellers must remain flexible as buyers might request extensions or raise concerns that require resolution.

Example: Consider John and Maria, who are buying a condo. Their offer includes subjects for financing, a home inspection, and strata document review. During the subject removal period, they discover an upcoming special assessment for major repairs. After consulting with their Realtor, they negotiate with the seller to adjust the purchase price to account for the unexpected cost.

Recommended Resource: Subject To Sale in BC – How It Works & Should You Avoid?

What Happens After Subject Removal?

Once subjects are removed, the contract transitions from conditional to firm and binding.

This is an exciting step for both the buyers and sellers, as the transaction should be moving along as planned with minimal obstacles for completion.

However, there are obligations that both parties must adhere to, to avoid the deal collapsing or other unintended consequences.

Impact of Not Removing Subjects

If the Subject Clauses are not removed during the subject removal process, this will void the deal altogether.

This can be unfortunate for both the buyer and seller, as the buyer will need to find a new property to make an offer on, and the seller will need to list the home again.

Extending the Subject Removal Date

Extensions of the subject removal date are sometimes necessary when unforeseen delays occur. Both buyers and sellers need to approach this situation with clear communication and a willingness to negotiate. Here is an in-depth look at how extensions work:

Common Reasons for Requesting an Extension

- Financing Delays: Sometimes lenders require additional time to process documents or appraisals, which may delay financing approval.

- Incomplete Inspections: A home inspection might reveal issues that require follow-up assessments, such as structural engineering reports or contractor quotes for repairs.

- Delays in Document Review: For strata properties, buyers may need extra time to review complex strata documents if the Condo Corporation is not providing the required documentation.

- Unexpected Personal Circumstances: Personal issues, such as illness or emergencies, can also necessitate an extension request.

When Does the Deposit Transfer?

The deposit is typically due within 24-48 hours of subject removal. This amount solidifies the buyer’s commitment and is held in the seller’s Realtor’s trust account until closing.

Other Resources

Here are other resources from reliable BC real estate organizations, associations, and us, on Subjects for residential real estate deals:

- Can you explain sellers’ and buyers’ contractual obligations?

- Back-Up Offers: There’s a Clause for That #519

- Home Buyer Rescission Period (HBRP) Calculators

- Buying a Home in British Columbia: A Consumer Protection Guide

Final Thoughts

The subject removal process is very common in the BC and Metro Vancouver real estate market.

While there can be periods during a sellers market, where buyers will make offers without Subject Clauses, it’s common to see Subjects.

With an understanding of how they work, common Subjects, and the process for removing them, you’ll be well prepared when you’re working with your Realtor in buying or selling your home.